If you are going to switch to self-consumption, you may have doubts about the tax system:

Do I have to pay taxes for having solar panels?

Is the solar tax still in force?

Can I receive rebates on certain taxes for installing solar panels on my home?

We answer these questions throughout the article to help you make a decision that will allow you to enjoy clean energy and reduce your electricity costs every month.

What was the sun tax and when was it repealed?

The sun tax generated a lot of noise.

It was a tax that affected the use of solar energy and the installation of solar panels on homes. To be more correct, we are talking about a “backup toll” that was approved in 2015 in Spain and repealed in 2018.

What were your feelings about this new tax on solar panels?

Fear.

It caused many single-family homes to reject photovoltaic installations.

So while in Spain limits were placed on the installation of solar panels, in other countries such as Germany, which has fewer hours of sunshine per year, as stated by the World Meteorological Organisation, photovoltaic self-consumption was encouraged.

What this tax caused in Spain was a delay in renewable energies, while neighbouring countries grew and overtook us in the left lane without any difficulty.

Fortunately, the tax was repealed in 2018 and there was a change in the legislation through Royal Decree 244/2019 that marked a new direction for Spain in the development of renewable sources.

A set of policies to boost the energy transition and achieve the objectives set by the European Union in 2030.

What changes occurred after the repeal?

In 2019, one year after the derogation, the advantages became increasingly visible.

Do you want to know what they are?

Here are a few:

-

The first, and most obvious, was the elimination of the tax for solar panels. Paying to generate your own energy? Not anymore.

-

In installations with a capacity of less than 10 kW and discharged to the grid, it is not necessary to ask for authorisation from the electricity distributors, that is, most homes.

-

Initially, the use was limited to single-family houses. This regulation allowed communities of neighbours to enjoy solar energy in their homes, known as collective self-consumption.

-

The introduction of surplus compensation, i.e. electricity companies will have to financially compensate you for the energy fed into the grid. The result? A reduction in your electricity bill.

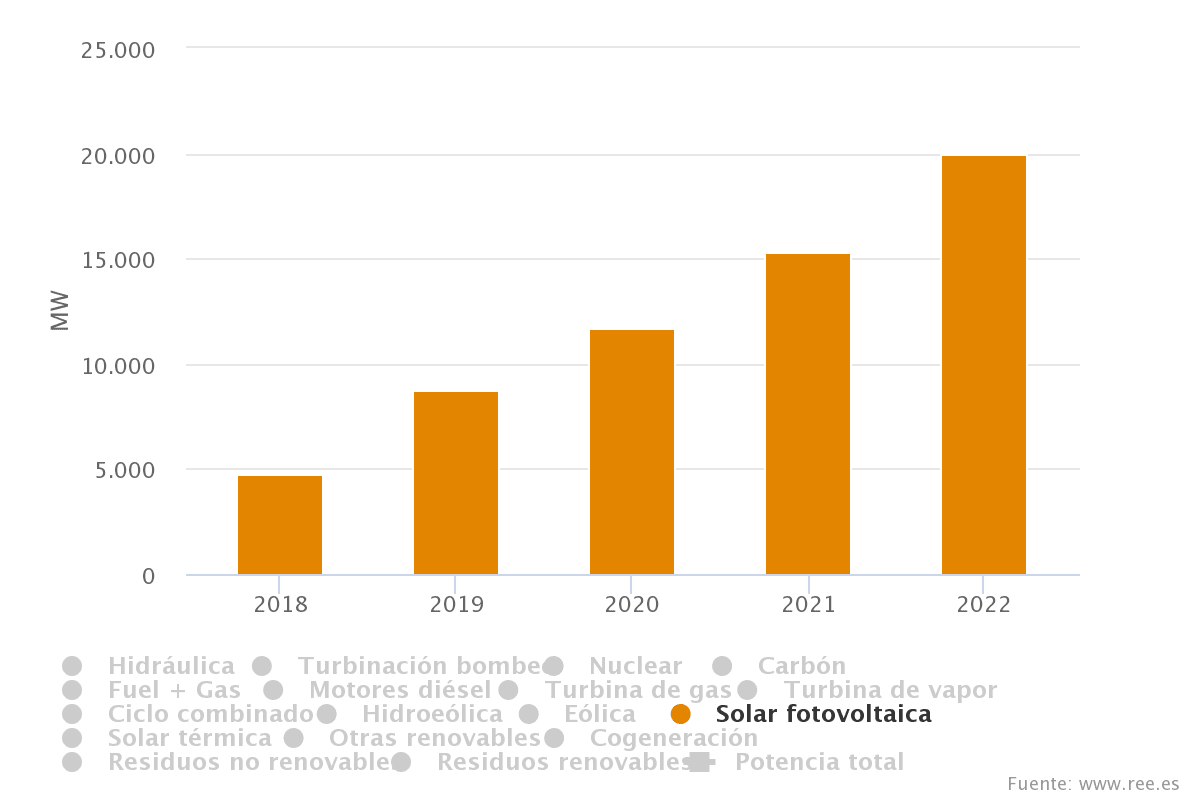

All these factors encouraged the growth of applications in Spain, which has not stopped increasing year after year.

Just take a look at the following graph:

Source: Red Eléctrica de España

The high electricity prices have drawn all the attention to the use of photovoltaic energy.

And no wonder.

If you can reduce your electricity bill by 50%, the investment pays off in the domestic economy.

Considering that the cost of installation is getting lower and lower and the costs in cold or hot seasons are becoming more and more unsustainable, we are looking for economic alternatives that do not increase the cost of electricity.

Do I have to pay taxes for solar panels?

Taxes for solar panels, i.e. the sun tax, is a term of the past. You do not have to pay for the mere fact of enjoying solar energy and installing a self-consumption system on your roof.

But you do have to take into account the following common taxes:

-

Value Added Tax (VAT). This amount is paid on any good or service in different percentages depending on the type of good. In this case, it is 21%, although if we are talking about a home renovation it can be reduced to 10%. Take a look at this article for more information on the reduced VAT on solar panels.

-

Tax on Construction, Installations and Works (ICIO). This tax is levied on any type of construction that requires a building or urban planning licence. It is not a fixed percentage, but varies depending on the municipality and cannot exceed 4%.

Tax advantages for the installation of solar panels

Photovoltaic production has experienced significant growth since the elimination of the sun tax. New policies and subsidies were also established to reduce the negative impact of fossil fuels, with the intention of making clean and economical energy easily accessible to households and businesses in the country.

It is true that there is state aid, the well-known Next Generation Funds, but subsidies for solar panels are established at the regional level. Therefore, you will receive one subsidy or another depending on the municipality where you live and, ultimately, this will have an impact on the return on investment.

There are more and more facilities to switch to self-consumption, what are you waiting for?

The repeal of the sun tax and the new green transition policies have propelled solar energy to stardom.

Incentives aimed at the use of renewable energy sources facilitate access to photovoltaic installations and accelerate the return on investment.

In addition, not only will you make significant savings on your electricity bill, but you will also..:

-

You will reduce pollution levels

-

You will incentivise the creation of new jobs.

-

Help strengthen the economy

>> Get started today and discover all the advantages of installing solar panels on your home.